If the medication you’re taking is perfectly affordable, would you bother switching to another one even when it works just as well? Probably not.

The vast majority of Savings Alerts and Notifications we generate have an obvious incentive to act on them: the ability to save yourself anywhere from $5 to $500 or more per fill. For clients who choose to turn them on, we generate Client Savings Alerts, which represent little or no savings for the member but significant savings for the employer or health plan—often hundreds and sometimes thousands per fill.

However, if a member isn’t presented with one of these alerts, or isn’t compelled to be a hero and save their company or health plan money, it’s a missed opportunity to control overall healthcare costs.

Unfortunately, there are too many missed opportunities out there for our clients for a variety of reasons, primarily:

- A member is in a PPO or any plan option with nominal pharmacy copays

- A member has reached his/her deductible in a high-deductible plan, so the plan is paying full freight for the medication

- A member is utilizing copay assistance from a brand drug’s manufacturer and paying zero or very little per fill

We developed the Rx Rewards incentive program to convert more of those opportunities. Here’s how it works:

- We analyze a client’s claims looking for drugs with sizable employer/plan cost, modest member cost, and available lower-cost options that are easy switches for the member

- We reach out to those members via email or mailed letter, offering a Visa¨ Prepaid Card in exchange for switching to the lower-cost option

- Simple instructions direct the member to either log in to the Member Portal or get in touch with our Pharmacy Support team; either way, the team facilitates the prescription change

Easy for everyone, yet serious positive impact on pharmacy spend, as these two examples show:

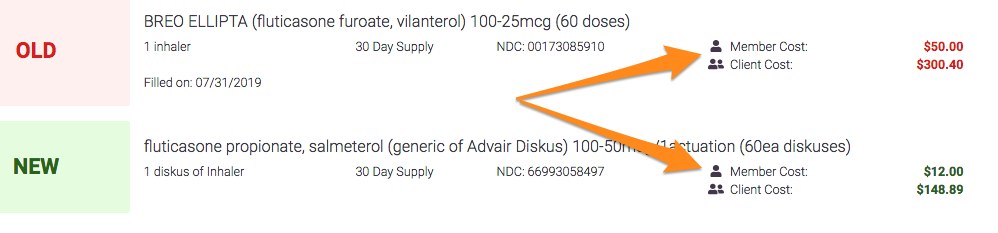

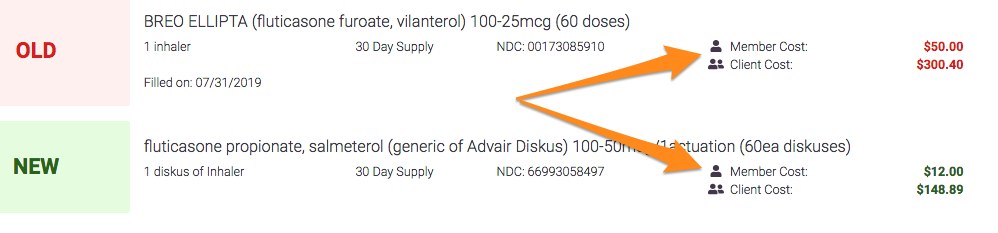

Exhibit A) Member moves from brand asthma inhaler with copay assistance to a generic therapeutic equivalent. The member’s cost goes from $50 to $12. The client’s cost goes from $300.40 to $148.89.

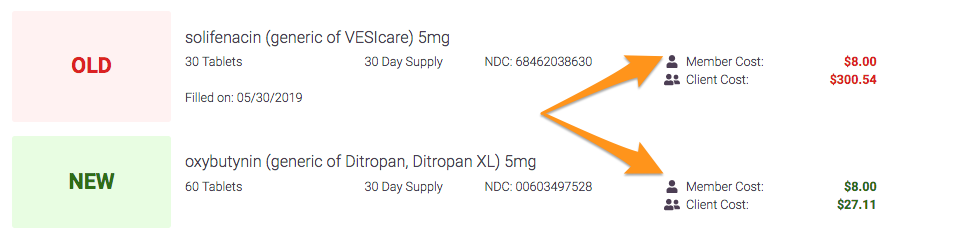

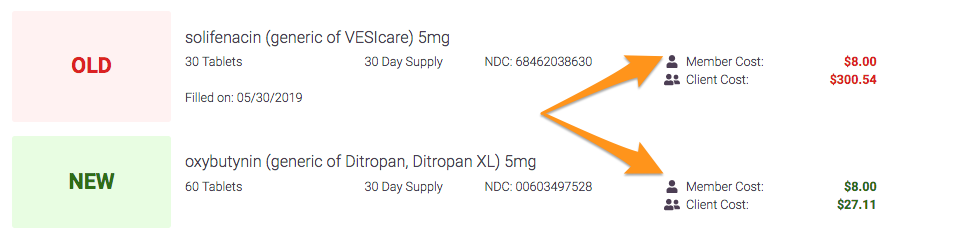

Exhibit B) Member moves from an expensive generic (due to exclusivity rights) to a generic therapeutic equivalent. The member’s cost remains at $8. The client’s cost goes from $300.54 to $27.11.

That’s how you turn $100 (or whatever incentive amount) into thousands of dollars saved per year for a plan. Multiply that by the thousands of members who take advantage of the incentive and you get an idea of the overall impact.

Clients aren’t the only ones who benefit. Before deductibles reset or copay assistance expires, members can pre-empt the pain that awaits when the cost burden shifts back to them with their current medication. That’s when the real rewards kick in.